As the deadline for updated filings approached last Friday, Grayscale, a leading crypto asset management firm, submitted its third amendment for a spot bitcoin ETF. Analyst Eric Balchunas shared an excerpt, highlighting the absence of authorized participant details, a key SEC requirement. The regulator mandated these updates for the initial decision round, with the first deadline set for Jan. 10, notably for Ark Invest and 21shares’ joint filing.

Despite not naming authorized participants, Grayscale’s CEO, Michael Sonnenshein, asserted that they had secured participants since 2017, referencing a June 2022 news article naming Jane Street and Virtu Financial as potential partners upon SEC approval.

In contrast, various competitors, such as BlackRock, WisdomTree, Fidelity, Valkyrie, and Invesco/Galaxy, have identified their authorized participants in their filings, with names like Jane Street, JPMorgan, and Virtu Financial.

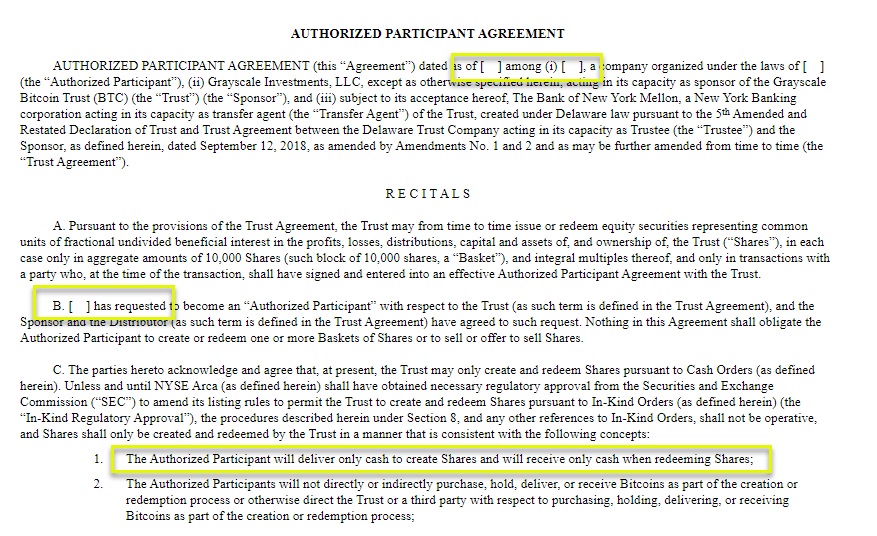

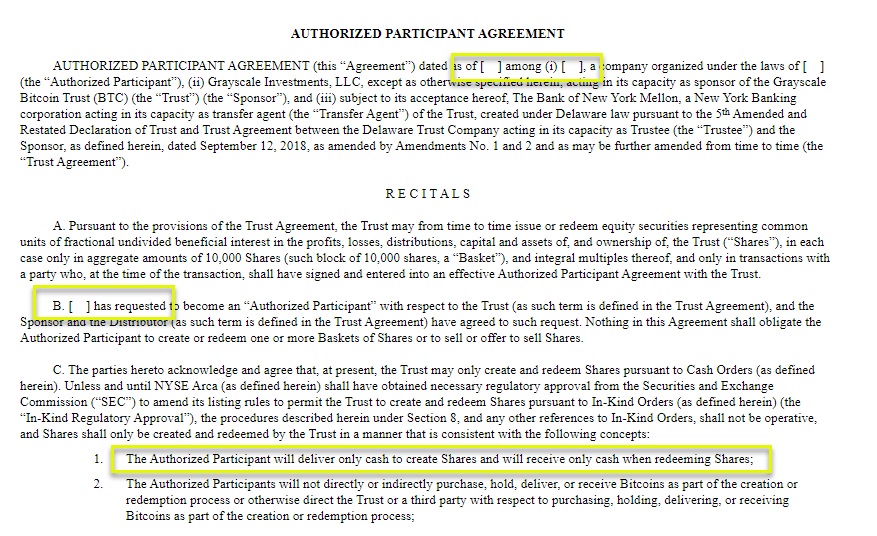

Grayscale’s spot bitcoin ETF proposal, initially rejected by the SEC, faces a court order for reevaluation. The SEC’s insistence on the cash creation method, despite Grayscale’s preference for the in-kind creation model, led to the company adopting the cash method in its second amendment. Notably, the recent resignation of Barry Silbert from Grayscale’s board of directors adds an additional layer of intrigue to the ongoing developments.

The pivotal question remains: Will Grayscale emerge among the first to gain SEC approval for spot bitcoin ETFs? Share your thoughts in the comments section below